Compound Wind and Flood risk

I am a research associate in climate risk analytics associated with the UK Centre for Greening Finance and Investment. My research focuses on compound wind and flood risks, historically and in the future.

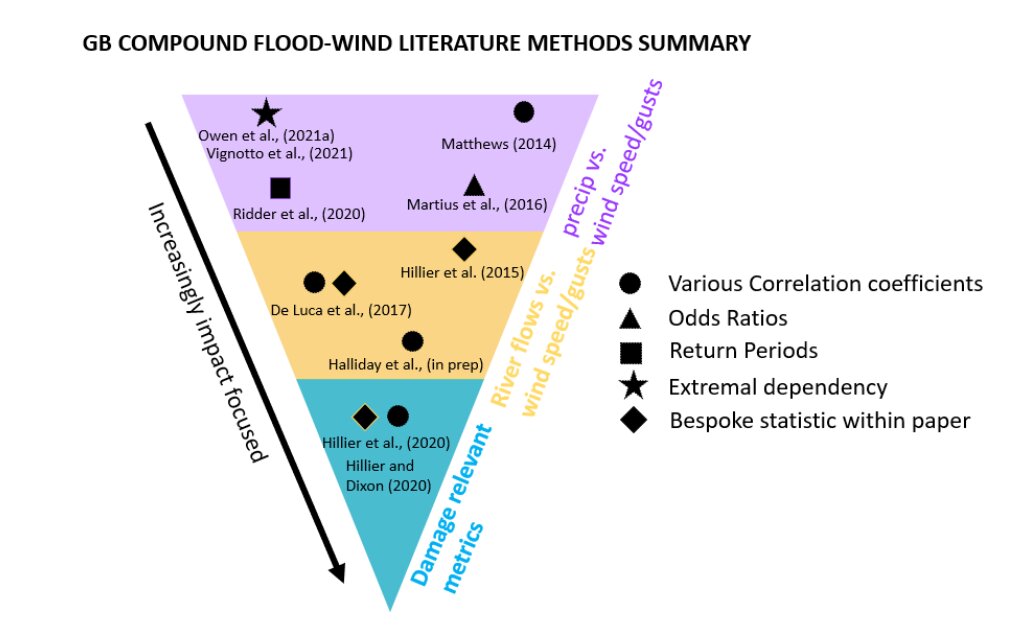

Strong winds and extremes in precipitation are capable of producing devastating socio-economic impacts across Europe. Although it is well known that individually these drivers cause billions of Euros of damage, their combined impacts are less well understood. Previous work has either focused on daily or seasonal timescales, demonstrating that compound wind and precipitation events are commonly associated with passing cyclones or particularly wet and windy years respectively.